Homeowners around the country are seeking the best insurance with the most value, the most reliable coverage, the lowest deductible, and the lowest price. Fortunately, homeowners insurance policies have many palatable options in large cities such as Houston. In Houston, Homeowners insurance policies should cover a few main areas such as weather damage, theft, and deterioration of the home. A few companies are at the top of the list that every homeowner should consider. In addition, there are a few unique features to think about when it comes to finding the best homeowners insurance in Houston, TX.

Liberty Mutual is one of Houston’s most significant companies providing homeowners insurance policies. Deductibles are relatively low, and the variety of home insurance options is comprehensive. However, the company is outside of Houston and does not appeal the same way more local insurers do. On the other hand, the firm has decades of experience in Texas, so it should be perfectly capable of providing all insurance services required. The company also provides auto and life insurance to diversify its portfolio.

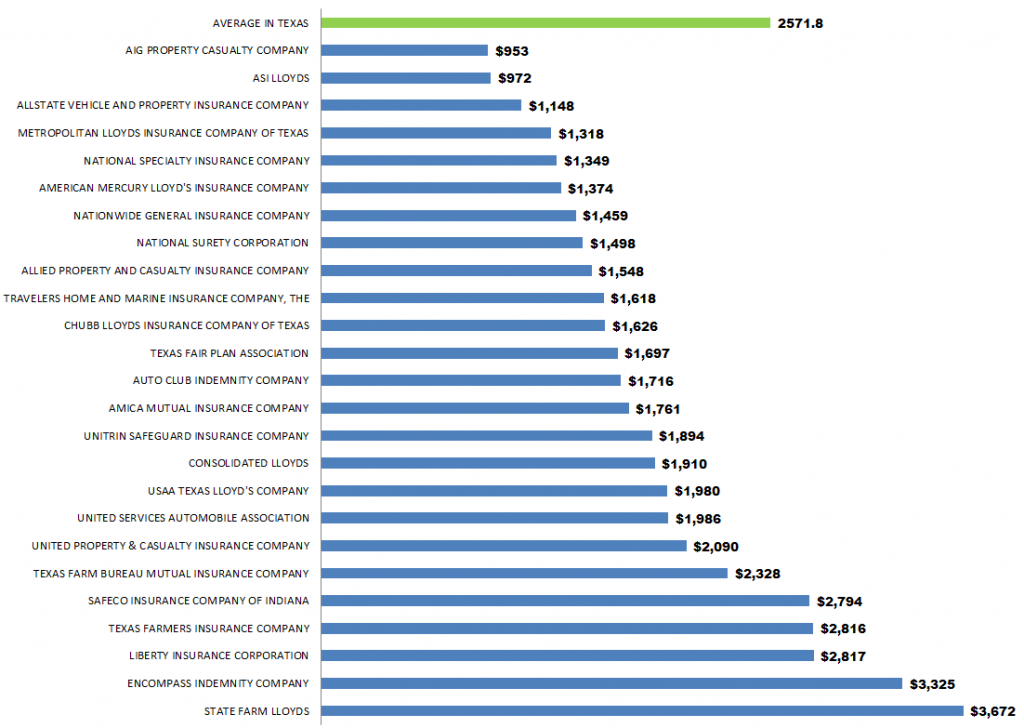

Chart of Insurance Rates by Companies Serving Houston, TX – Coverage: $150,000

The data shown below fits the following criteria:

- County & ZIP Code: HARRIS 77002

- Age of Residence: 10 years old (1-34)

- Type of Construction: Brick Veneer

- Claim History: Claim free for five years

- Credit Rating: Good Credit

- Policy: Homeowners

- Coverage Amount: 150000

| Company Name | Annual Sample Rate WITH wind coverage | A.M. Best Rating | Complaint Index | % Rate Change WITH Wind Coverage | ||

|---|---|---|---|---|---|---|

| 12mo | 24mo | 36mo | ||||

| AIG PROPERTY CASUALTY COMPANY | $953 | A | 0 | 0 | 3.14 | 3.14 |

| ALLIED PROPERTY AND CASUALTY INSURANCE COMPANY | $1,548 | A+ | 0 | -4.97 | -2.7 | -4.85 |

| ALLSTATE VEHICLE AND PROPERTY INSURANCE COMPANY | $1,148 | A+ | 0 | -2.71 | -2.71 | -2.81 |

| AMERICAN MERCURY LLOYD’S INSURANCE COMPANY | $1,374 | A- | 0 | 8.1 | 20.1 | 9.14 |

| AMICA MUTUAL INSURANCE COMPANY | $1,761 | A++ | 0.7554 | -.23 | 4.66 | n/a |

| ASI LLOYDS | $972 | A | 0.8769 | -51.1 | -51.1 | -46.5 |

| AUTO CLUB INDEMNITY COMPANY | $1,716 | A+ | 0.9339 | 0 | 6.19 | 9.23 |

| CHUBB LLOYDS INSURANCE COMPANY OF TEXAS | $1,626 | A++ | 0 | 4.16 | 8.18 | 8.18 |

| CONSOLIDATED LLOYDS | $1,910 | 0 | 0 | 0 | 35.46 | |

| ENCOMPASS INDEMNITY COMPANY | $3,325 | A+ | 2.1905 | 33.11 | 54.37 | 64.44 |

| LIBERTY INSURANCE CORPORATION | $2,817 | A | 0.916 | 20.08 | 38.91 | 65.22 |

| METROPOLITAN LLOYDS INSURANCE COMPANY OF TEXAS | $1,318 | A | 0.7247 | n/a | n/a | n/a |

| NATIONAL SPECIALTY INSURANCE COMPANY | $1,349 | A | 0 | 0 | 9.05 | 3.6 |

| NATIONAL SURETY CORPORATION | $1,498 | A+ | 0 | 18.79 | 41.99 | 38.44 |

| NATIONWIDE GENERAL INSURANCE COMPANY | $1,459 | A+ | 1.2996 | 9.12 | -9.71 | -6.29 |

| SAFECO INSURANCE COMPANY OF INDIANA | $2,794 | A | 1.3324 | 54.88 | 80.96 | 84.54 |

| STATE FARM LLOYDS | $3,672 | B++ | 1.2578 | -.38 | 4.08 | 18.23 |

| TEXAS FAIR PLAN ASSOCIATION | $1,697 | 1.1742 | 0 | 18.01 | 18.01 | |

| TEXAS FARM BUREAU MUTUAL INSURANCE COMPANY | $2,328 | A- | 0.9991 | 3.15 | 12.63 | 20.5 |

| TEXAS FARMERS INSURANCE COMPANY | $2,816 | A | 0.9926 | -5.15 | 21.65 | 50.92 |

| TRAVELERS HOME AND MARINE INSURANCE COMPANY, THE | $1,618 | A++ | 0 | 6.94 | n/a | n/a |

| UNITED PROPERTY & CASUALTY INSURANCE COMPANY | $2,090 | 0 | 1.7 | n/a | n/a | |

| UNITED SERVICES AUTOMOBILE ASSOCIATION | $1,986 | A++ | 0.4783 | 2.64 | 25.62 | 23.21 |

| UNITRIN SAFEGUARD INSURANCE COMPANY | $1,894 | A- | 4.1828 | 1.34 | 20.26 | 20.26 |

| USAA TEXAS LLOYD’S COMPANY | $1,980 | A++ | 0.3401 | 2.75 | 25.8 | 23.44 |

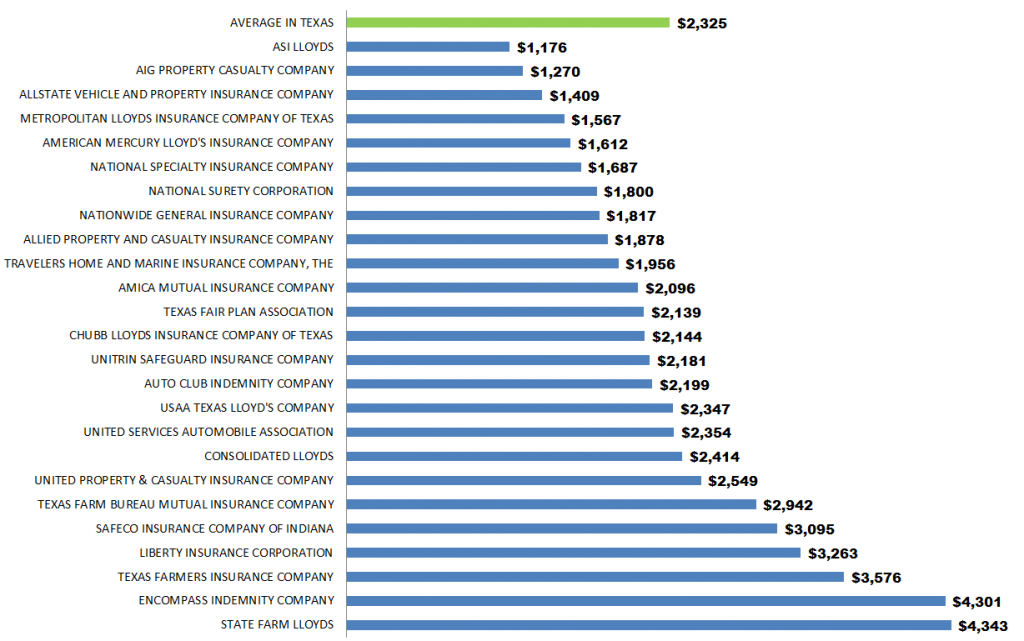

Chart of Insurance Rates by Companies Serving Houston, Tx – Coverage: $200,000

The data shown below fits the following criteria:

- County & ZIP Code: HARRIS 77002

- Age of Residence: 10 years old (1-34)

- Type of Construction: Brick Veneer

- Claim History: Claim free for five years

- Credit Rating: Good Credit

- Policy: Homeowners

- Coverage Amount: 200000

| Annual Sample Rate WITH wind coverage | A.M. Best Rating | Complaint Index | % Rate Change WITH Wind Coverage | ||

|---|---|---|---|---|---|

| 12mo | 24mo | 36mo | |||

| $4,343 | B++ | 1.2578 | -1.96 | 2.1 | 15.58 |

| $4,301 | A+ | 2.1905 | 34.11 | 54.48 | 64.65 |

| $3,576 | A | 0.9926 | -5.15 | 21.71 | 52.42 |

| $3,263 | A | 0.916 | 19.88 | 38.45 | 68.12 |

| $3,095 | A | 1.3324 | 47.1 | 71.84 | 73.87 |

| $2,942 | A- | 0.9991 | 3.16 | 12.64 | 20.48 |

| $2,549 | 0 | 1.7 | n/a | n/a | |

| $2,414 | 0 | 0 | 0 | 35.54 | |

| $2,354 | A++ | 0.4783 | 2.66 | 26.9 | 24.81 |

| $2,347 | A++ | 0.3401 | 2.76 | 27.07 | 25.04 |

| $2,199 | A+ | 0.9339 | 0 | 6.13 | 9.19 |

| $2,181 | A- | 4.1828 | 1.3 | 21.16 | 21.16 |

| $2,144 | A++ | 0 | 4.08 | 12.73 | 12.73 |

| $2,139 | 1.1742 | 0 | 17.98 | 17.98 | |

| $2,096 | A++ | 0.7554 | -2.83 | 1.93 | n/a |

| $1,956 | A++ | 0 | 7.24 | n/a | n/a |

| $1,878 | A+ | 0 | -5.06 | -3.45 | -5.77 |

| $1,817 | A+ | 1.2996 | 9.13 | -12.2 | -8.89 |

| $1,800 | A+ | 0 | 34.13 | 60.43 | 56.26 |

| $1,687 | A | 0 | 0 | 9.19 | 3.73 |

| $1,612 | A- | 0 | 6.4 | 14.57 | 2.35 |

| $1,567 | A | 0.7247 | n/a | n/a | n/a |

| $1,409 | A+ | 0 | -3.16 | -3.16 | -3.26 |

| $1,270 | A | 0 | 0 | 3.08 | 3.08 |

| $1,176 | A | 0.8769 | -51.6 | -51.6 | -47.1 |

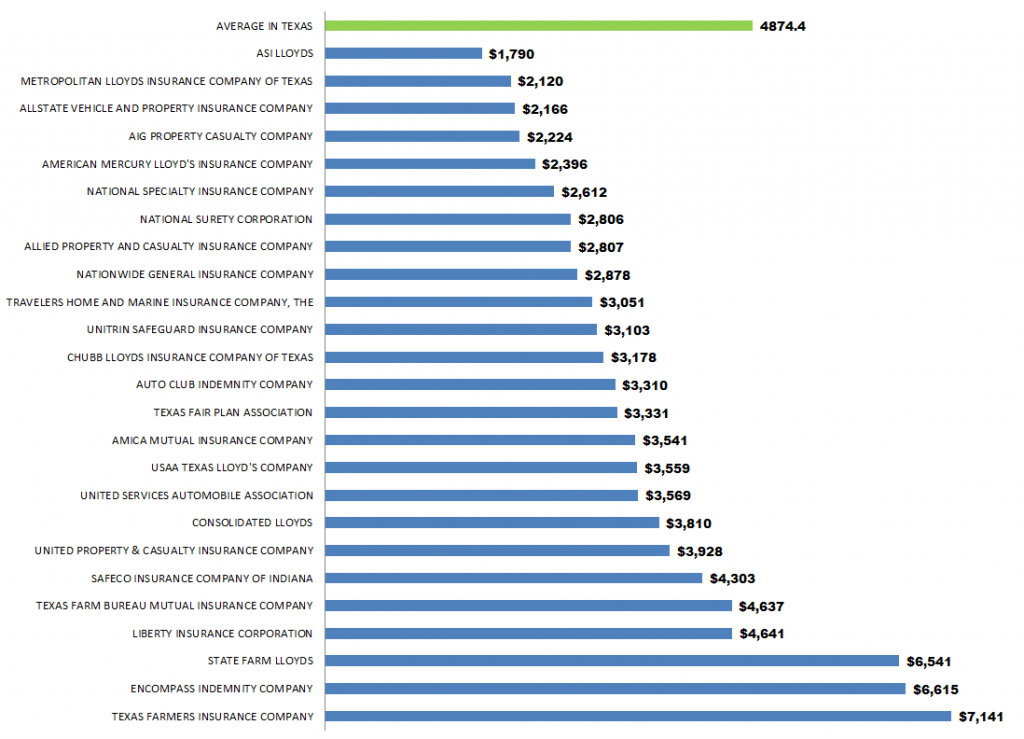

Chart of Insurance Rates by Companies Serving Houston, Tx – Coverage: $350,000

The data shown below fits the following criteria:

- County & ZIP Code: HARRIS 77002

- Age of Residence: 10 years old (1-34)

- Type of Construction: Brick Veneer

- Claim History: Claim free for five years

- Credit Rating: Good Credit

- Policy: Homeowners

- Coverage Amount: Homeowners

| Company Name | Annual Sample Rate WITH wind coverage | A.M. Best Rating | Complaint Index | % Rate Change WITH Wind Coverage | ||

|---|---|---|---|---|---|---|

| 12mo | 24mo | 36mo | ||||

| AIG PROPERTY CASUALTY COMPANY | $2,224 | A | 0 | 0 | 3.15 | 3.15 |

| ALLIED PROPERTY AND CASUALTY INSURANCE COMPANY | $2,807 | A+ | 0 | -4.13 | -4.13 | -6.5 |

| ALLSTATE VEHICLE AND PROPERTY INSURANCE COMPANY | $2,166 | A+ | 0 | -3.99 | -3.9 | -4 |

| AMERICAN MERCURY LLOYD’S INSURANCE COMPANY | $2,396 | A- | 0 | 11.81 | 17.4 | 1.52 |

| AMICA MUTUAL INSURANCE COMPANY | $3,541 | A++ | 0.7554 | 1.9 | 6.89 | n/a |

| ASI LLOYDS | $1,790 | A | 0.8769 | -52.4 | -52.4 | -47.9 |

| AUTO CLUB INDEMNITY COMPANY | $3,310 | A+ | 0.9339 | 0 | 6.12 | 8.91 |

| CHUBB LLOYDS INSURANCE COMPANY OF TEXAS | $3,178 | A++ | 0 | 4.06 | 14.85 | 14.85 |

| CONSOLIDATED LLOYDS | $3,810 | 0 | 0 | 0 | 35.68 | |

| ENCOMPASS INDEMNITY COMPANY | $6,615 | A+ | 2.1905 | 36.03 | 55.65 | 58.82 |

| LIBERTY INSURANCE CORPORATION | $4,641 | A | 0.916 | 17.73 | 35.81 | 79.67 |

| METROPOLITAN LLOYDS INSURANCE COMPANY OF TEXAS | $2,120 | A | 0.7247 | n/a | n/a | n/a |

| NATIONAL SPECIALTY INSURANCE COMPANY | $2,612 | A | 0 | 0 | 9.29 | 3.83 |

| NATIONAL SURETY CORPORATION | $2,806 | A+ | 0 | 27.55 | 52.42 | 48.7 |

| NATIONWIDE GENERAL INSURANCE COMPANY | $2,878 | A+ | 1.2996 | 8.24 | -16.2 | -13.0 |

| SAFECO INSURANCE COMPANY OF INDIANA | $4,303 | A | 1.3324 | 53.19 | 79.08 | 77.82 |

| STATE FARM LLOYDS | $6,541 | B++ | 1.2578 | -4.32 | 4.88 | 23.9 |

| TEXAS FAIR PLAN ASSOCIATION | $3,331 | 1.1742 | 0 | 18.04 | 18.04 | |

| TEXAS FARM BUREAU MUTUAL INSURANCE COMPANY | $4,637 | A- | 0.9991 | 3.18 | 12.71 | 20.57 |

| TEXAS FARMERS INSURANCE COMPANY | $7,141 | A | 0.9926 | -5.15 | 22.7 | 60.61 |

| TRAVELERS HOME AND MARINE INSURANCE COMPANY, THE | $3,051 | A++ | 0 | 7.17 | n/a | n/a |

| UNITED PROPERTY & CASUALTY INSURANCE COMPANY | $3,928 | 0 | 1.7 | n/a | n/a | |

| UNITED SERVICES AUTOMOBILE ASSOCIATION | $3,569 | A++ | 0.4783 | 2.65 | 28.81 | 27.29 |

| UNITRIN SAFEGUARD INSURANCE COMPANY | $3,103 | A- | 4.1828 | 1.31 | 19.44 | 19.44 |

| USAA TEXAS LLOYD’S COMPANY | $3,559 | A++ | 0.3401 | 2.74 | 28.99 | 27.47 |

Farmers Insurance is another Houston homeowners insurance option. The firm prides itself on its quick turn-around time on all claims and its excellent customer service and support. In addition, the firm will go out of its way to provide the total amount of insurance claim that you deserve. Deductibles and monthly premium payments are higher, but you are more likely to win a share when you submit it in exchange. For example, suppose a contractor damages your home while repairing or renovating it. In that case, you can get coverage from Farmers for that damage that is a part of your overall plan and does not require an additional add-on. Furthermore, Farmer’s provides a whole suite of investment, business, life, and vehicle insurance products.

Nationwide is one of the most well-known insurers in the area. They provide a range of services and have robust financial backing. Nationwide has a solid marketing plan and has a TV, radio, and online presence. However, they focus on auto insurance, so their providing of homeowners insurance in Houston is not quite as strong. Premiums are a bit high vs. the value they provide for claims.

Allstate is another insurance company that provides services in the region. Different homeowners insurance policies from Allstate vary in scope. For example, you can forego ice damage coverage if you want a relatively less expensive option. While the risk of ice damage in Houston is shallow, it is not out of the question. Storm and hurricane damage are much more common and are a more standard feature of policies. In addition, the firm has a prominent renters insurance offering that protects from theft or weather damage to personal property.

Additional Aspects For Homeowners Insurance in Houston, TX

Consumers living in Houston with a homeowners insurance option often have homes with landscaping and gardens. Many wonder whether their current policies cover the damage. Things like falling trees are covered as long as they damage a part of the property. If they fall without any damage, homeowners insurance in Houston, TX, may not cover the removal. Additional Homeowners Insurance Houston policy coverage options would pay for removing such items as trees or other landscaping failures.

Additional options for good insurance coverage for those with pools in their backyard in Houston. Not only for repair and emergency cleaning but also in the case where there is an injury due to your liability. All of the major companies listed above have options for pool insurance.

The Homeowners Insurance Houston market continues to grow and expand. As the region’s economy diversifies and expands, the insurance market grows. Homes are still sprouting up all around the area from Downtown to Katy, Sugarland, Pearland, and Pasadena. Transactions for new and old homes alike continue to grow, and with each transaction, a new homeowner requires a Houston home insurance policy.

Comments are closed.